Island Fintech Weekly (31 Oct)

Greetings Islanders,

Hope you’ve had a great week! Here’s my round up of all things fintech this week to round off the weekend. Also, I could use this view.. couldn’t you? 🏝

Note: Are you looking to raise angel funds for your fintech? Have any questions or thoughts around Wise’s Platform API? Reach out to me via LinkedIn.

🐠 Dips

1️⃣ Bank Jago turned profitable!

Indonesia’s favourite yellow bank, Bank Jago, managed to swing around its 6 year loss streak this third quarter of 2021.

The bank’s new management, backed by Goto, has been helping drive partnerships and distribution efforts, as well as adding new products - the key here in enabling profitability being tech-enabled loans. Loan disbursements rose 72% in a mere quarter to roughly $263m from around $153m. Directly as a result of this - interest income jumped to $25m.

Like most banks, the loan-book is still one of the most profitable bits of the biz - something that digital banks typically cannot offer. Jago, however, was once a traditional licensed bank going by the name of PT Bank Artos Indonesia Tbk - so the capability has always existed. Now that it has a shiny new face and a better distribution strategy, it seems like sky is the limit for Bank Jago.

2️⃣ UOB and Fave launch a rewards program

UOB is working together with Fave to offer a unique rewards platform on its banking app, TMRW. Customers will be able to have a wider number shopping options as well as savings when they pay for exclusive deals from merchants with their credit card reward points on UOB TMRW.

Fave is good at acquiring merchants. They have already integrated as a payment option in many retail and F&B outlets, including mom and pop stores. So this would make for an interesting way for UOB to distribute the typical credit card-like loyalty programs that are reserved for, well, credit cards. It makes sense, as it seems like credit cards are increasingly losing relevance with BNPL - so UOB is staying in the loop by offering rewards for what’s essentially an e-wallet.

3️⃣ Nium launches Crypto-as-a-Service

Nium recently announced the launch of a new crypto-as-a-service offering. The offering will be via API, and will allow financial institutions to support five cryptocurrencies in the U.S. in 2021, with the list of supported currencies growing to 20 in 35 countries in 2022.

It’s clear that crypto is coming to the mainstream. Digital bank platforms that can offer crypto typically have the opportunity to make a lot of money - nearly half of Robinhood’s revenue came from its fairly recent crypto sales, of which Dogecoin accounted for 62%. Digital banks would then realise that offering crypto is a major bonus - but the integration against an exchange can be difficult. Working with an API like NIUM’s makes sense - this is something that Bitstamp and Coinbase Cloud already offer in differing flavours, but mostly looking at the US. I would be intrigued to see how this is solved for SEA. How do KYC problems get resolved, and how do we get regulators comfy?

4️⃣ NTUC Income expands across SEA.. for ride hailing rain insurance

NTUC Income is dipping its feet into the rest of SEA to help insure against literal rainy days. Yes, you read that right. I didn’t know this myself, but Droplet is essentially NTUC insurance to provide a consistent fare for days you’ll expect to call a cab, and if it rains (and the price surges), NTUC will reimburse you right into your PayNow wallet. Check out the site, it’s actually pretty cool.

Apparently some insurers in Indonesia, Vietnam and Malaysia also thought that this was pretty cool. The cooperative announced that it is expanding into these regions with distributed partnerships with insurers - effectively insurance as a service.

This could be a good way for NTUC start working with known insurers on a novel insurance product, before finding ways to perhaps distribute other products through the region, such as their Snack micro-insurance platform.

5️⃣ Zolve raises a $40m Series A

Zolve, a 10 month old digital banking startup that aims to help immigrants in the U.S. gain access to financial services, raised $40m in a new financing round as it begins to roll out its offerings.

This is a really large amount to have raised for such a young company. Zolve, who counts the Indian immigrant community as its core audience, rolled out its credit card to 2,000 customers (and amassed a waiting list that has surpassed 70,000) last months.

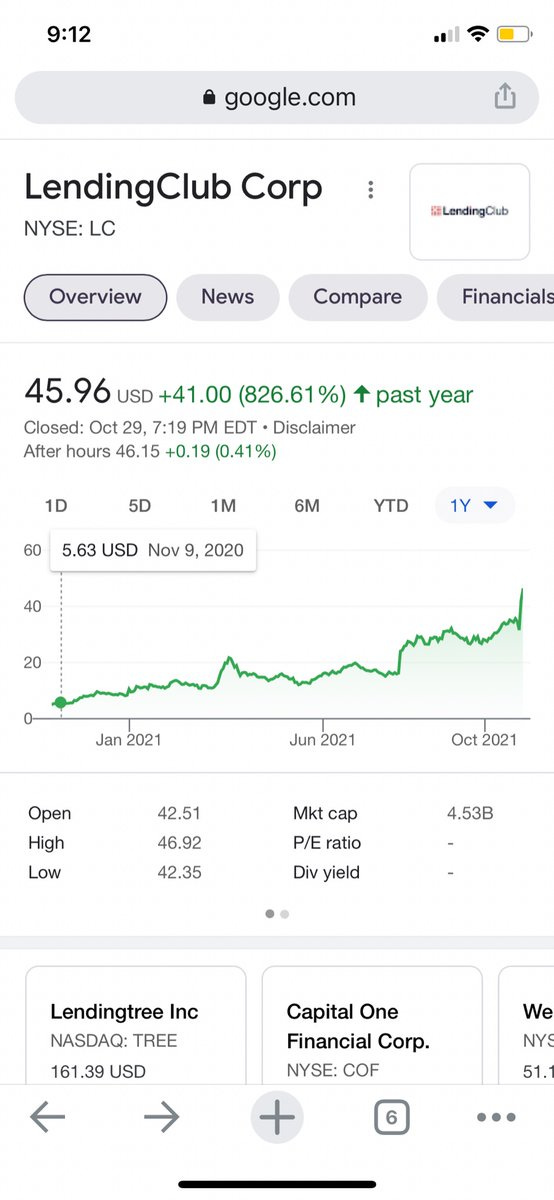

For some context, the two largest neobanks in the US raised comparatively much smaller Series A’s - back in 2016/7ish era. Chime, which currently has 13.1m customers, raised a $9m series A. Current, at 4m customers today, raised a $5m Series A. We are truly in a new era of fintech funding.

🐋 Dives

4 key stats from Finder’s report on digital banking adoption (KR Asia)

Making Financial Services Easy to Code (a16z)

Banking sucks, so we made it great. Now let’s fix carbon. (Pledge)

🍹 Twitticisms

(P.S. Again, if anyone has SEA or Asia focused fintech Twitter accounts I should be following, tweet me. The accounts I see on my feed are overwhelmingly 🇺🇸 focused)

The opinions and views posted above are solely personal and are not indicative of the views of the author’s employer.